Tooltester is supported by readers like yourself. We may earn an affiliate commission when you purchase through our links, which enables us to offer our research for free.

In 2008, Mike Butcher of TechCrunch published an article about a brand new website builder called Webnode:

“Webnode appears to have been on mars for the past few years as it is launching a Web site building tool ignoring moves by some little-known players called Google, WordPress, Six Apart and others.”

That quote pretty much shows how website builders were seen at the time.

When we fast forward a few years, Six Apart’s brands Movable Type and Typepad will only ring a bell with web veterans while the Czech company Webnode claims to have more than 15 million users, doubling their team size to more than 70 within just a few years.

WordPress, on the other hand, still powers a huge chunk of the web – about one in every six websites, totalling to more than 77 million sites. But many technophobes now prefer easier drag and drop solutions as setting up WordPress.org can be quite a technical chore for inexperienced users.

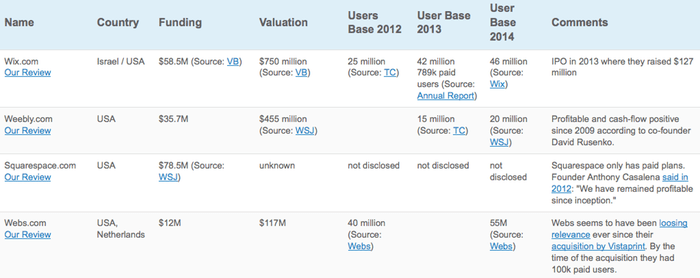

In our website builder market analysis for 2014, we discovered that WordPress’ closest neighbours (in terms of their valuation and user base) are Wix, estimated to be worth $750 million, and Weebly, worth $455 million. Together with Webs.com, these companies host a significant part of today’s web on their servers.

| Company | ||||

| Valuation | $1.16 billion | $750 million | $455 million | $117 million |

| Users | 77 million | 46 million | 20 million | 55 million |

In turn, there are some smaller players quickly catching up to these well-known, established names and attracting massive numbers of users. Good examples are – again – Webnode and also Jimdo. Incredibly, they are accomplishing this with barely any investment.

The website builder has gained new respect as a viable tool for website publishing, and we wanted to see how the market has evolved.

How Many Users?

Geocities was one of the first website builders most of us came into contact with, although it was a primitive take on the phrase. It was purchased by Yahoo!, who unceremoniously (and permanently) deleted all of its content shortly afterwards.

Since then, the technology available has changed, and website builders are more sophisticated. A site created using a website builder in 2014 does not look like a Geocities site at all. In fact, it can be as sophisticated as a WordPress site. This is reflected in the soaring user numbers across many website builder brands, as well as a widespread adoption of site builders in business contexts:

- Some website builders are aimed at the B2B market, and therefore benefit from healthy corporate buy-in and multi-tier adoption. This helps to increase the user base very rapidly. Two good examples are CM4All and Basekit; both provide white label site builder solutions, and both have enjoyed healthy investments. We can estimate the user base for CM4All at around 3 million.

- Then, we have site builders that are growing organically under their own brand. Here, Jimdo is an interesting example. It hosts 10 million websites, doubled from 5 million in 2010.

- We also need to look at paid and free options. Wix has increased its user base from 25 million to 46 million in just two years, but it has a large proportion of free users (about 98.3%). Webnode has tripled its user base in two years, so the freemium model seems to be a great marketing tool.

- Webs was bought out by Vistaprint for $117.5 million in 2011. The Dutch printing giant seems to have failed on capitalising on the success of the brand; its popularity has been in dwindling, at least according to Google Trends.

One way to measure success is to look at the number of paying customers. Companies are reluctant to give this information out, but even with limited data, we can determine that a massive user base doesn’t automatically mean healthy profits. 1&1, for example, is still not out of the red according to their latest annual report.

| Company |  |

|||

| Users | 77m | 55m | 42m | Only paid accounts |

| Paying customers | Fewer than 1% across .com, and none using self-hosted | 100k (in 2011) | 789k by the end of 2013 | 520k by mid-2014 |

How Much Investment?

In the website builder market, investment undoubtedly fuels growth. Across the board, we see angel and venture funding boosting user numbers, as you’d expect.

Wix and Squarespace are the clear winners when it comes to raising funds. In 2013, Wix raised a staggering $127 million in its IPO – making it the biggest Israeli IPO ever. That gave the company a valuation of $750 million, higher than Weebly, valued at $455 million. Wix previously raised cash from four separate rounds of funding between 2007 and 2011.

| Company |  |

||||

| Users | 46,000,000 | Not disclosed | 20,000,000 | 10,000,000 sites | 800,000 |

| Funding | $58.5 million (before IPO) | $78 million | $35.7 million | Refused | Refused |

Again, Jimdo stands out (with Cabanova) as one of the exceptions to the rule. Cabanova is a smaller player in the market, but both companies are based in Germany and appear to share the same ethos: investment could compromise freedom.

Our Detailed Look at all the Major Players

As no one had ever done a comprehensive and up-to-date overview of all major website builders, their user base and investment, we thought that this could be very useful for everyone who is looking at the market. From now on, you can find our comprehensive website builder market overview here where we list all of our sources.

Bucking the Trend

The website builder market has its fair share of winners and mavericks, but Jimdo stands out as a company that is daring to be different. By actively encouraging Geocities refugees to transfer their sites, it cleverly marketed its service to existing webmasters. And, as it’s growing without investment, it is achieving something that other companies dare not even try.

Matthias Henze, co-founder, says the secret is getting the ethos of the company right: “developing a great product and having a good customer support. We love our users! Our main growth driver remains viral organic growth.” The company employs 180 people in Hamburg, San Francisco and Tokyo.

Back to the Future

In 2008, TechCrunch wrote off Webnode as an outdated company, doomed to fail and become a footnote in the development of the web. Six years later, 15 million users prove that Webnode was on to a great idea. The rise of the website builder market has taken many people by surprise, yet it’s a credit to the power of the tools on offer – and the dedication of innovative companies worldwide – that website builders are an efficient and affordable way to create a website fast.

Written by Claire Brodley and Robert Brandl

THE BEHIND THE SCENES OF THIS BLOG

This article has been written and researched following a precise methodology.

Our methodology