Tooltester is supported by readers like yourself. We may earn an affiliate commission when you purchase through our links, which enables us to offer our research for free.

Shopify is growing fast. So far over 1m stores have been built using Shopify’s technology. In the US and Canada, Shopify is a household name, especially since they went public in 2015. It’s often the first platform that comes to mind when users think about building an online store.

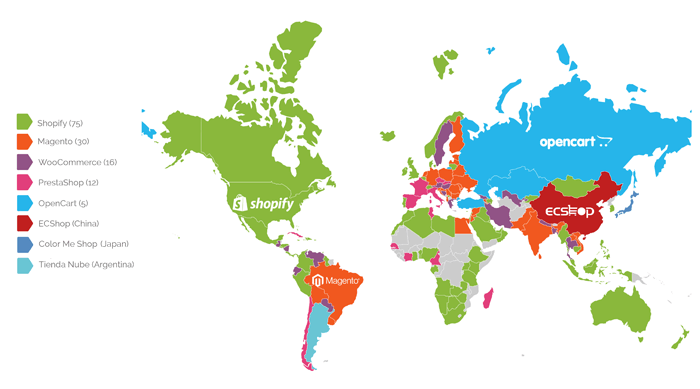

But is this the case for the rest of the world? Just how popular is Shopify worldwide, and what are the other platforms it competes with?

To answer this question, we took a look at the most popular ecommerce builders in each country, taking data from Google Trends and Builtwith.

Here’s what we found:

Click to view interactive map (data taken from Google Trends and Builtwith)

As it turns out, Shopify dominated most of the map, and in particular the US and Canada (the second and eighth largest ecommerce markets in the world, respectively). Which isn’t a surprise to anyone, considering Shopify’s historical focus on North America (we talk more about that below).

They were also the most popular platform in other English-speaking countries such as the UK, Ireland, Australia, New Zealand and South Africa. But they were also highly searched-for in the majority of African and Middle Eastern countries (for which we had data), many southeast Asian countries, a handful of European countries and some regions of Latin American and the Caribbean.

But, this wasn’t the case everywhere. As we found, there were some similarities among clusters of countries, as well as a few surprises.

The dominance of open source systems in Europe

In the south of Europe (France, Spain and Italy), French ecommerce platform Prestashop proved to be the most widely searched-for platform. Built with European requirements in mind, Prestashop offers features such as compliance with EU regulations and translations/multilingual features, which help to facilitate cross-border sales across the continent.

Elsewhere in Europe (and specifically, Germany and Eastern Europe), Adobe-owned Magento seemed to dominate search results. Their popularity likely stems from their global reputation of offering a robust solution that caters to small and large retailers alike.

WooCommerce was another popular ecommerce builder in Europe, with high search volumes in a handful of countries, including Austria, Hungary, Greece, Bosnia and Herzegovina, and Sweden. This powerful WordPress plugin (which is widely touted as the world’s most-used ecommerce builder) is renowned for being cost-effective, versatile, and an ideal solution for smaller store owners whose sites run on WordPress.

So what’s driving Europe’s apparent obsession with open source platforms overall? Stricter data regulations apply in Europe compared to other parts of the world, and privacy concerns are often front-of-mind for European retailers. It therefore makes sense that many would opt for open source systems, which provide a greater amount of control and flexibility than proprietary systems like Shopify do.

It’s also worth noting that this high adoption of open source systems extends to countries on the fringes of Europe, too. Hong-Kong based OpenCart was the most-searched ecommerce platform in Russia, Turkey and Kazakhstan, and is also renowned for offering an affordable and flexible multilingual solution.

The special case of China and Japan

While bigger systems like Shopify, Magento and WooCommerce seemed to be popular in many regions of Asia (particularly in Southeast Asian countries and India), it’s interesting to note that this wasn’t the case in China or Japan.

These important ecommerce markets are both characterized by giant online marketplaces that dominate the landscape. This is especially notable in China – the largest ecommerce market in the world – where 72.6% of the B2C ecommerce market is held by the two biggest marketplaces (Alibaba and JD), and smaller online stores are fairly uncommon. JD’s partnership with social media and messaging app WeChat last year also means that social shopping has been made much more accessible to this market. Additionally, shoppers in China enjoy high rates of cross-border shopping.

While this oligopoly applies to a lesser extent in Japan, large marketplaces (e.g. Rakuten, Amazon Japan) account for 50% of the country’s ecommerce sales. The remainder of the sales occur on fashion marketplaces, free market apps, and handmade product platforms.

With such firm barriers in place, these provide less incentive for businesses to build their own online stores. This is in stark contrast to the US and European markets, where most online sales occur through smaller stores.

As a result, none of the global ecommerce platforms we’ve discussed previously are particularly sought out in either China or Japan. Instead, in cases where store owners do decide to build their own store, they seem to opt for local (and less globally-known) platforms such as ECShop in the case of China*, and Color Me Shop in Japan (where the availability of software in the local language is extremely important).

*Note – as Google isn’t commonly used in China, we took this data from Builtwith.

Latin America’s preference for international platforms

Search results varied widely in Latin America. All the big ecommerce platforms seemed to be highly searched-for across South America, Central America and the Caribbean. In order of popularity, they were: Shopify, WooCommerce, Magento and Prestashop. Perhaps unsurprisingly, Shopify (which up until recently only allowed transactions in USD) was popular in countries where the USD was used or accepted – Panama, Costa Rica, Puerto Rico, and the Bahamas, for example.

The other countries seemed to opt for platforms that allowed for transactions in multiple currencies. In Brazil – where there are over 66 million ecommerce users – having a platform that supports Brazilian Reals is crucial, which is likely why Magento was the most searched-for solution.

The only exception was in Argentina, where local ecommerce platform Tienda Nube was the most searched-for builder. Like Shopify, it offers non-technical users a way to create an online store using its proprietary platform.

Shopify: on track to take over the world?

All of this tells a compelling story of differing needs and preferences across the world, but perhaps the most striking takeaway is that of Shopify’s dominance worldwide. They were the only provider to be trending in every continent, with particular strongholds in North America, Africa, Australasia and Southeast Asia.

What’s the reason behind this surge in popularity? Well, it’s no secret that Shopify have traditionally operated with a mindset focused on the US and Canada (which subsequently extended to other English-speaking countries, as well as countries where English was widely spoken – something that Shopify themselves admit was accidental). Marketing, support, and of course, the product itself, were previously all only available in English, and they put all their energy into fully serving this significant global market.

It’s a strategy that has clearly paid off for them thus far. However, recent updates to the platform demonstrate that they’re ready to take on parts of the world that have been a little harder to crack.

In 2018, Shopify released the platform in six additional languages: French, German, Spanish, Italian, Brazilian Portuguese, and Japanese. At the same time, they also expanded their Shopify Payments offering to more countries, allowing stores to offer local payment options to customers. They also started supporting an additional nine currencies worldwide (where they had previously only supported USD).

With their shifted focus on new markets, could they realistically take over the world? There seems to already be pockets of interest in Europe and Latin America, and it’s clear that they’re aiming to grow their presence in these regions even further.

However, time will tell whether they have the capacity to overcome the unique challenges posed by each of their targeted regions (the preference for open source software in Europe, the popularity of online marketplaces in Japan, and the need to support transactions in Brazil’s local currency, for example). But based on their success so far, the odds are certainly looking in their favor.

Data Sources:

As stated initially, we mostly relied on Google Trends for our data. Why?

While it doesn’t represent market shares per se but rather how popular a product is in a certain country (based on the number of Google searches), we think there is a pretty strong correlation with the actual market share (current and future). There are other data sources available (Builtwith, Datanyze) but their data sets are often very small for many countries, especially in the case of Datanyze. That’s why we didn’t feel confident to rely on their data. The only time we used Builtwith data was in the case of China where Google Trends is not a reliable indicator.

Feel free to use this map on your own website giving attribution.

Let us know what you think about this map in the comments below!

THE BEHIND THE SCENES OF THIS BLOG

This article has been written and researched following a precise methodology.

Our methodology