Tooltester is supported by readers like yourself. We may earn an affiliate commission when you purchase through our links, which enables us to offer our research for free.

If you type “ecommerce” into Google, like I just did, you’d soon be presented with a link to Shopify. It’s safe to say, Shopify is the leading eCommerce solution out there. And out of the e-commerce solutions that we’ve tested, they sit comfortably at the top of our best ecommerce builders list. This is mainly thanks to their ease of use, flexibility, customer responsiveness, and many other appealing features.

However, one of the pain points of using Shopify used to be card payments processing. In the past, store owners had to use a third-party payment solution, which was expensive and time-consuming.

Could this all be a thing of the past now that they offer their own payment solution? To find out, I’ve tested Shopify Payments to see if it makes sense for you to use them.

Let’s see what Shopify have to offer with its own payment processing solution…

Shopify Payments Overview

Shopify Payments lets Shopify merchants accept payments online without having to integrate a third-party payment processor.

If you use Shopify Payments in your store, you’ll be charged:

- 30¢ for every online card transaction

- Plus 2.4% – 2.9% of the value of each transaction, depending on your Shopify plan

By using Shopify Payments, you’ll avoid the extra Shopify transaction fees

What is Shopify Payments?

Shopify Payments is a payment processing service that is fully integrated with the Shopify platform. It allows merchants that use Shopify to accept card payments directly through their online store without using a third-party payment processor.

With Shopify Payments, merchants can easily set up their payment methods, configure their payment settings, and most importantly, start taking online payments for their products.

Before we get into more detail about how Shopify Payments works, let’s define a couple of key terms in the eCommerce world…

What is a Payment processor?

A payment processor is a company that manages the transaction process of online purchases made with credit cards, debit cards, and digital wallets. In a nutshell, they are in charge of communicating the payment information from the customer’s card and bank account to the merchant’s bank account.

Payment processors always charge a fee for their services, which will typically be a percentage of the transaction amount or a fixed fee.

Examples of Payment Processors:

- Stripe

- PayPal

- Square

- Adyen

- Flagship Merchant Services

- Apple Pay

- GoCardless

What is a Payment Gateway?

While they’re often referred to synonymously, a payment gateway is in fact very different from a payment processor.

A payment gateway is a software service that provides a secure connection between a merchant’s ecommerce store and a payment processor. It is responsible for transmitting the card data from the customer to the payment processor.

Now that you are a little bit more familiar with these terms, let’s summarize:

Shopify Payments is the in-house payment processor for Shopify, which they introduced to cut out the middleman. To create an easier checkout process for both Shopify customers and store owners, they introduced their own in-house payment solution by partnering with the payment processor, Stripe.

Shopify Payments is only available to ecommerce store owners using the Shopify platform. By implementing Shopify Payments, Shopify store owners can accept the following payment methods:

- Mastercard

- Visa

- American Express

- Discover

- Diners Club

- Elo

- JCB

Pros of Shopify Payments

- Lower fees: If you don’t use it, you’ll be charged extra fees on top of your processing fees.

- Convenience: With Shopify Payments, you don’t need to sign up to a separate payment processor or merchant account. You can start accepting payments as soon as you create your Shopify store.

- Integrations: Shopify Payments is fully integrated into the Shopify platform, so it’s easy to set up and use. This means you can manage all of your payments, orders, and customers in one place.

- Fast payouts: When you use Shopify Payments, your payouts are fast and reliable. You can choose to receive your payouts as often as every business day, and you can also set up automatic payouts so you don’t have to manually request them.

- Security: Shopify Payments offers fraud protection, automatic chargeback protection, and real-time payment tracking

- International payments: Shopify Payments supports a wide range of currencies and can accept payments from customers around the world.

- Better conversion rate: A great advantage is that with Shopify Payments, customers stay on your website at all times. With PayPal, they are redirected to the platform, which can decrease the conversion rate

- Better customer experience: By choosing Shopify Payments, you are offering a quick and easy checkout for your customers, helping to keep their buying experience stress-free.

- Customer support: As a Shopify merchant, you have access to customer support from Shopify’s team of experts, who can help you with any issues related to Shopify Payments.

Cons of Shopify Payments

- Not available in every country: if you’re outside of the listed locations, tough luck.

- Must comply with product T&Cs: unfortunately, if your business falls into Shopify’s prohibited categories, you won’t be able to use Shopify Payments.

- Chargeback fees: according to Shopify, they get billed $15 every time a chargeback occurs, but unfortunately, you’re the one who pays for it.

- Frozen Funds: while they investigate chargeback errors or suspicious account activity, many users complain about frozen funds within the Shopify forums.

What are Shopify Payments Fees?

Like every payment provider, if you are using Shopify Payments, you will be charged a credit card processing fee to cover the cost of processing the payment.

With Shopify Payments, it’s worth noting that their processing fees are pretty competitive compared to other payment processors, and the rate you are charged depends on which Shopify plan you are on.

- Basic Shopify – 2.9% + $0.30 for every online transaction and 2.7% + $0.00 for in-person payments.

- Shopify – 2.6% + $0.30 for online and 2.5% + $0.00 for in-person.

- Advanced Shopify – 2.4% + $0.30 for online and 2.4% + $0.00 for in-person

If you are unable (or choose not to) to use Shopify Payments, then you will still have to use another payment processor, in order to take online payments.

And not only will they charge you a similar processing fee to Shopify Payments, but Shopify will also charge you a new “transaction fee” on top of that (more on this below).

This can all get quite confusing when you’re trying to work out how much you will actually pay to use Shopify Payments (or an alternative) on the different Shopify Plans. Luckily, we have created a calculator to help you out here:

Shopify Pricing Calculator

Cross-border fees

Shopify Payments also charges a cross-border fee for transactions that involve a currency conversion. This fee is 1% of the transaction amount on the Basic Shopify plan and 0.5% on the Shopify and Advanced Shopify plans.

Can Everyone use Shopify Payments?

Geographical Limitations

Unfortunately, not everyone is welcome to use Shopify Payments. As we mentioned in the Cons section, Shopify Payments is only available in certain countries. Here is the list of countries where you can use Shopify Payments:

- Australia

- Austria

- Belgium

- Canada

- Denmark

- Germany

- Hong Kong SAR

- Ireland

- Italy

- Japan

- The Netherlands

- Belgium

- New Zealand

- Singapore

- Spain

- Sweden

- United Kingdom

- United States (does not include US territories, except Puerto Rico)

Business Type Limitations

Unfortunately, location isn’t the only constraint. Depending on the territory where you operate, there are varying services/products you are not allowed to sell. You can check the full list of restricted items here.

For example, Shopify US restricted business types include:

- Legal services

- Adult content

- Gambling (and much more)

Shopify Payments Alternatives

As a Shopify store owner you can choose from a variety of third-party payment processors, and even without Shopify Payments, you can enable multiple payment methods for your customers to choose from.

For example, if you want to let your customers pay by credit and debit cards, you can choose from over 100 card processing providers. And alternatively, to allow your customers to pay online without a card, you can enable the following methods: PayPal, Meta Pay, Amazon Pay, and Apple Pay.

So, if you do decide to take an alternative route and choose a third-party payment method without enabling Shopify Payments, there are a few things to bear in mind…

As mentioned earlier, if you choose a third-party payment method without enabling Shopify Payments you will be charged transaction fees for any payments made through these external providers.

The fees charged cover the cost for Shopify to integrate with an external payment provider and the fee amount varies depending on your Shopify plan, the payment service, and the type of payment being processed.

Here are the current rates:

- Basic Shopify – 2.0%

- Shopify – 1.0%

- Advanced Shopify – 0.5%

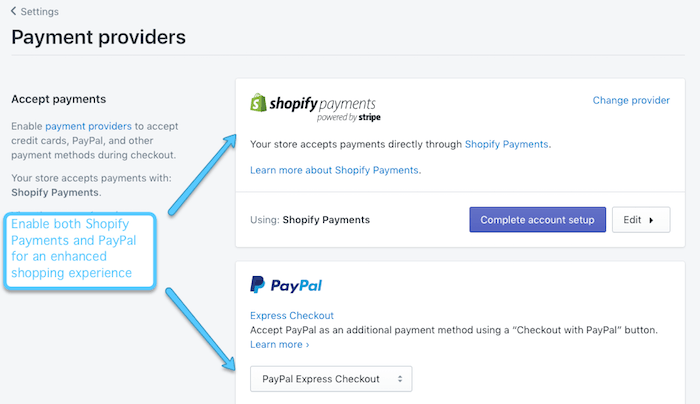

As confusing as it seems, the main thing to consider here is that if you enable Shopify Payments alongside other third party payment providers, you won’t be charged any transaction fees.

Let’s use PayPal as an example:

Scenario A: A customer paid using PayPal, and you didn’t have Shopify Payments enabled, therefore Shopify will charge you both the transaction fee and the processing fee.

Scenario B: Your customer checks out using PayPal and you had Shopify Payments enabled, therefore you won’t be charged that extra transaction fee, just the processing fee.

Now, this doesn’t only apply to PayPal, but all other third-party providers. In the US, the most popular ones are:

- Amazon Pay

- Paypal Express

- Visa Cards

- American Express

- Klarna

- Maestro

In our opinion, choosing whether or not you should enable Shopify payments alongside other third-party payment providers is a no-brainer – the process is almost identical, yet you are avoiding the extra fees.

Stripe vs Shopify Payments

As we explained earlier, Shopify Payments is processed by Stripe. But if you prefer to use Stripe separately, you can set up your own Stripe account for your online business.

Unfortunately, there is a catch – Stripe is nowhere near as easy to implement as Shopify Payments. In fact, you won’t even find Stripe as an option within your Shopify account settings.

To set it up, you’ll need to contact Shopify directly and provide a legitimate reason for why you need to use Stripe and an account specialist can look into adding the Stripe option to your account.

Although some Shopify store owners claim that Stripe’s customer support quality is better, the pros of using Shopify Payments vs Stripe definitely outweigh the cons, these include:

- Shop Pay

- No transaction fees

- Competitive processing rates

- In-house support

- Financial reports

- Detailed Payout Information

- Automated chargeback handling

How Does Shopify Payments Work?

How does Shopify Payments Process Funds?

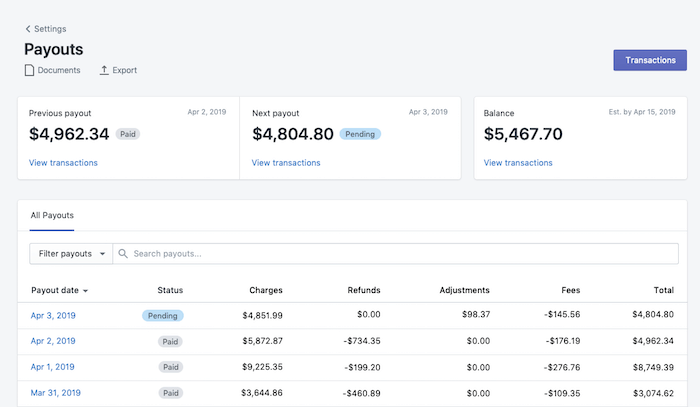

This is the coolest part about Shopify Payments. You can track your money in real-time, directly from your Shopify dashboard. This is one of the key advantages of Shopify Payments, there’s no need for you to log into an external platform every time.

As for payment processing time, for Shopify store owners in the US, funds usually takes 3 business days to reach your bank account. Although, it can take longer depending on your location, for instance, 7 days for Canadian users.

Does Shopify Payments Work with Multiple Currencies?

Yes, Shopify Payments comes with support for multiple currencies. Prices are automatically converted based on:

- Current currency rate

- Your rounding rule

The first one is pretty straightforward. It’s also worth noting Shopify doesn’t overcharge or use hidden fees, unlike PayPal.

Rounding rules are a useful tool to make your prices look neat to customers when conversion rates vary a lot. So for instance, you can decide that all prices should end in 0.99 or 0.90, no matter how far the conversion takes it.

What Happens When I Sell in Person?

Once you have set up Shopify Payments for your online store, you can accept credit card payments in person. The process is quick and easy, you need to activate it in the Shopify POS app.

- Head to Shopify POS app

- Go to Settings > Payment settings.

- Next, in the Default Payment Types section, verify that the Credit/debit option shows Accepted.

If your store is based in one of the supported countries, then you can use a Shopify card reader to accept credit card payments. A crucial thing to remember is that, if you want to accept in-person POS payments in multiple countries, you must create a separate Shopify store and Shopify Payments account for each additional country. This is to ensure that you are following the payment rules for the country you’re processing the transaction within.

What About the Dreaded Chargebacks within Shopify?

What is a Credit Card Chargeback?

A credit card chargeback (or payment dispute) occurs when a cardholder asks their bank to reverse a transaction. They provide consumer protection and reimbursement for any fraudulent transactions. For example, if a cardholder suspects their card has been used fraudulently, they can request a chargeback from their bank and the funds will then be held until the bank resolves the issue.

As you can probably tell, chargebacks are a pain for any store owner – and even more so for eCommerce store owners who rely on online payments.

Shopify charges $15 every single time a chargeback happens. And unfortunately for you, your funds might be frozen if it happens regularly. Chargebacks are the number one complaint from Shopify Payments users as many believe the fraud prevention system is inadequate.

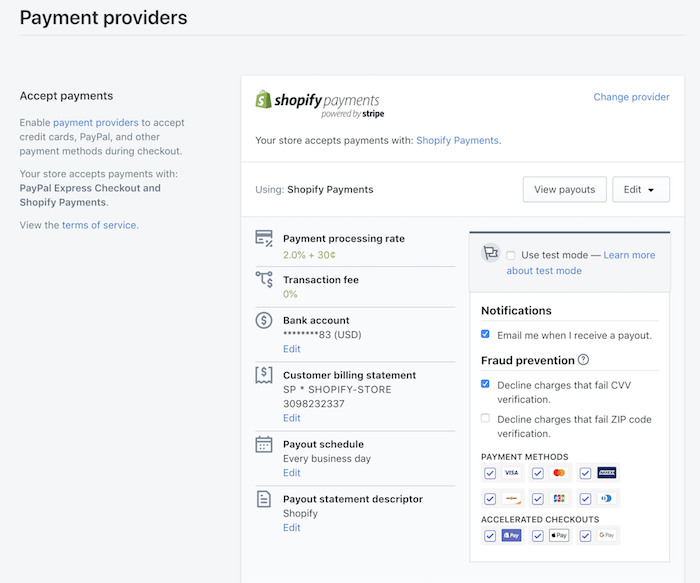

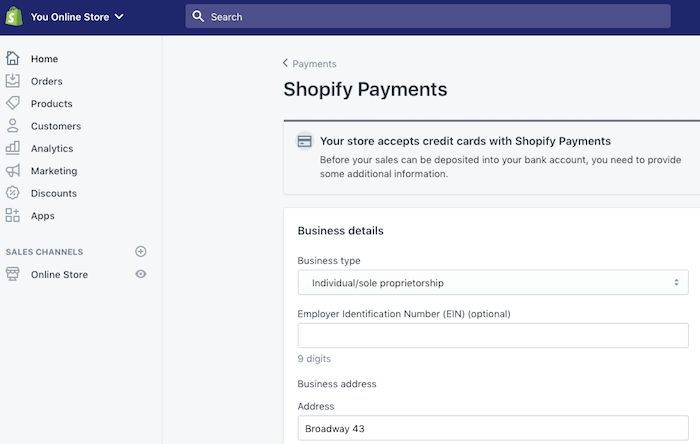

How to Set up Shopify Payments

Last but not least, how to set up Shopify Payments. One of the main advantages is that activating Shopify Payments is extremely easy. Even more so if you are already a Shopify user, you’ll just need to prepare the following documents:

- your Employer Identification Number (EIN)

- your banking information

- the average price of your items

- the average shipping time

Don’t worry if you haven’t set up your Shopify store yet, you can head to our step-by-step guide where we walk you through the entire process. It’s also worth mentioning that depending on where you are based, you may need to gather some additional documentation to set up Shopify Payments. Refer to the list of requirements for each supported country.

Fortunately for you, the good news is that it won’t take more than a few minutes for you to get started – which is a lot faster than other gateways.

You can apply for Shopify Payments in 5 easy steps:

Step 1- Login into your Shopify account

Step 2 – Go to Settings > Payment providers

Step 3 – Click ‘Complete your Shopify Payments setup’

Step 4 – Fill in your Business details, Personal details, product details, and banking information

Step 5 – Click the Complete Account Setup button to finish the process.

After you have submitted this information, Shopify will review and (hopefully) approve your application so that you can start processing payments with Shopify Payments.

Shopify Payments – Final Takeaways

Finally, it’s no secret that Shopify wants you to use their payment solution over other payment methods. If you’re already a Shopify user, that’s great, you’ll be able to receive payments with ease. And kudos to Shopify, their decision to remove the transaction fee makes store owners feel as though they are saving money by choosing their in-house payment solution. However, there may be more affordable Shopify alternatives that don’t charge such transaction fees, so it’s worth investigating other ecommerce options (if you’re not a Shopify user yet).

FAQ

Can I use other payment providers?

Yes. It’s possible to set up Shopify Payments, and still let users choose PayPal at checkout, for instance.

Will I be double-billed for using two providers?

No, you are only charged based on the gateway your customer chooses at checkout.

What other gateways are there?

The most famous ones include Authorize.net, Stripe, and PayPal. But there is a lot more to choose from, depending on your country.

We keep our content up to date

January 12 2023 - General update

THE BEHIND THE SCENES OF THIS BLOG

This article has been written and researched following a precise methodology.

Our methodology